No More 'Small and Beautiful' Phones? ASUS Halts Mobile Business as Niche Brands Near the Edge

Before we begin, a simple question: when you choose a smartphone today, do you prefer a large one or a small one? For me, the smartphone market has become rather dull in recent years. Almost every brand's product line seems cast from the same mold, with screens starting at 6.6 inches and weights approaching 220 grams. For those who miss easily mastering a device with one hand, with a thumb that can reach every corner of the screen, the options are dwindling.

Once, Apple's mini series was the last hope for this group, but it vanished with the iPhone 14 lineup. In the Android camp, ASUS's Zenfone series was like a modern Don Quixote, charging at windmills with its compact 5.9-inch body, guarding the last bastion of dignity for small flagship enthusiasts. However, it seems this knight has grown weary. According to a report from 9to5Android, ASUS has officially confirmed it will suspend the launch of new phones, including the Zenfone and ROG Phone, in 2026.

The news sent shockwaves through the community. For tech enthusiasts, ASUS's withdrawal is more than a strategic business decision; it's the end of an era. For users who cherished the feel of a small phone or sought the ultimate gaming experience, this is a significant blow. It begs the question: is the brand that represented the last bit of quirky persistence in the Android world really saying goodbye?

The 'Oddballs' of Yesteryear

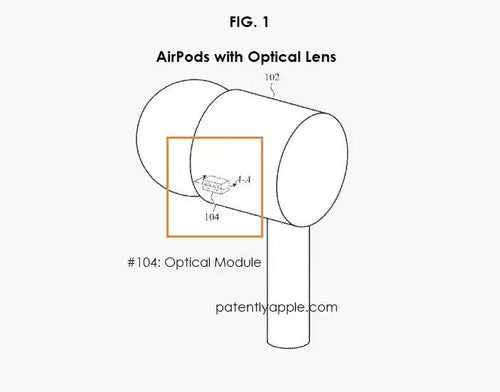

Looking back at ASUS's mobile history, you'll find a company with the romance and stubbornness of an engineer. They never seemed content to follow market trends, always aiming to impress consumers with unique innovations. From the early Padfone series—a phone that docked into a tablet shell—to the 2015 ZenFone Zoom, which featured a periscope lens for true optical zoom when others relied on digital, ASUS consistently demonstrated a courageous spirit of innovation, even if these ventures weren't always commercially successful.

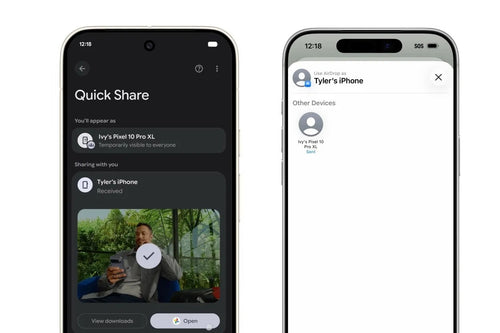

In recent years, ASUS narrowed its focus to two extremes. One path was the Zenfone, dedicated to lovers of small phones. Starting with the ZenFone 8, ASUS made a surprising move by committing to a 5.9-inch form factor while the rest of the industry chased larger sizes. This gamble paid off with the well-received Zenfone 9 and 10, proving a market existed for users wanting a flagship processor and top-tier camera in a pocket-friendly device. The other path was the ROG Phone, a line dedicated to hardcore gamers. It pioneered features like side-mounted charging ports for unobstructed landscape grip, AirTriggers for multi-finger control, and robust cooling systems. The ROG Phone never aimed for the mass market; it was built to please a niche audience, carving out its own territory in a crowded field.

Ideals Succumb to Reality

If the products were so unique and well-regarded, why is ASUS exiting the market? Ultimately, making phones is a business, and business decisions are driven by costs and profits. The direct cause appears to be rising costs. The mobile industry relies on a global supply chain, and with prices for key components like memory projected to soar by 25% by 2026, the financial pressure is immense. Giants like Apple and Samsung can leverage their massive order volumes to negotiate lower prices, but smaller brands like ASUS have little choice but to absorb the increase. This leaves them with two bad options: raise prices and lose competitiveness, or sacrifice profits and incur greater losses.

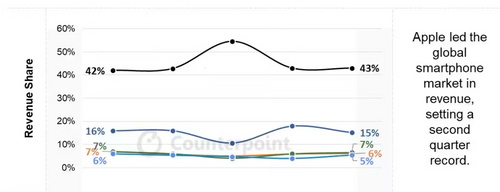

Furthermore, the global smartphone market has solidified into a 'sandwich' structure. At the top, Apple and Samsung dominate the high-end profits with their powerful brands and ecosystems. At the bottom, a legion of Chinese brands like Xiaomi, OPPO, and vivo engages in a fierce battle in the mid-to-low-end segments through scale and aggressive pricing. ASUS was caught in the middle, lacking the brand power to compete at the top and the scale to compete at the bottom. The mobile division has long been a financial drag on the company, accounting for just 1% of the group's total revenue in Q3 2023. Despite efforts to return to the mainstream, ASUS's market share in Taiwan was only about 1.2% in 2025, ranking seventh. From a business perspective, discontinuing a persistently unprofitable division is a rational, if not inevitable, decision.

When Individuality Gives Way to Survival

ASUS's departure is a microcosm of the entire smartphone industry's evolution. It reveals a harsh reality: in a mature and saturated market, the space for 'small and beautiful' niche players is shrinking. Brands like LG, HTC, Sony, and Smartisan, all with unique product philosophies, ultimately fell victim to the war of scale. In this war, victory is determined not by a few unique features, but by supply chain dominance, vast sales channels, and a robust software ecosystem. It's a game for giants.

Most consumers vote with their wallets, choosing products that are more comprehensive, affordable, and mainstream. We may miss the comfortable grip of a Zenfone or the unparalleled gaming experience of a ROG Phone, but these sentiments cannot change market trends. As an industry matures, homogenization and scale become the dominant forces, and the diversity that once sparked excitement slowly fades. ASUS's temporary exit is not the first, and it certainly won't be the last.