Leica's Sale Saga: A Faltering Giant in a Shrinking Market, and Will Xiaomi Make the Move?

Is the century-old optical giant, Leica, up for sale again? Recent reports from overseas media suggest that ACM and Blackstone Group are considering selling their controlling stake in Leica Camera. Public records show that Leica's ownership is split between Austria's ACM Projektentwicklung GmbH (55%) and the US-based Blackstone Group (45%). While the exact percentage of the sale is uncertain, it's highly likely that the transaction will result in a new majority shareholder taking control of the iconic brand.

This marks the fourth time Leica has faced a sale. Since 1986, the company has been spun off from its parent company, undergone bankruptcy restructuring, and later saw Blackstone's entry to form the current joint ownership with the Andreas Kaufmann family. For many consumers, Leica became a household name through its foray into mobile imaging, partnering first with Huawei and later with Xiaomi. As news of another potential sale surfaces, rumors are swirling that Xiaomi could be a potential buyer. How did a century-old optical powerhouse find itself repeatedly on the auction block, and is Xiaomi ready to step in?

Global Camera Market Shrinks, Leica Cornered

Leica's legacy began in 1914 with the Ur-Leica, pioneering the use of 35mm film. The mass-produced Leica I, launched in 1925, revolutionized photography with its compact and fast design. The Leica M3, released in 1954, is widely regarded as the pinnacle of rangefinder design, solidifying the M-series' legendary status. Yet, despite this storied history, Leica's singular focus on photography has become its Achilles' heel. While recent financial reports don't indicate a crisis—in fact, the 2023-2024 fiscal year saw revenue grow by 14% to €554 million, a record high, followed by another 7.6% increase in 2024-2025—this success is deceiving. The revenue surge was largely fueled by its mobile imaging partnership with Xiaomi, revealing a fragile and non-diversified business model.

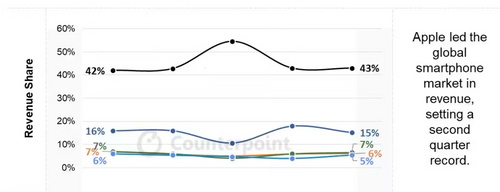

Unlike its competitors, Leica's revenue streams are almost exclusively tied to consumer optical products and brand licensing. Giants like Canon and Fujifilm have diversified into printers and medical imaging, Nikon has arms in semiconductor equipment, and Sony is a colossal conglomerate spanning gaming, music, and electronics. In the fiscal year 2025, Leica's revenue of €596 million (approx. ¥4.9 billion) pales in comparison to Sony's quarterly revenue of over ¥3 trillion (approx. ¥130 billion) and Fujifilm's ¥3.3 trillion (approx. ¥140 billion). As the digital camera market continues to be cannibalized by mobile photography, Leica's future looks increasingly uncertain. This lack of diversification is likely the real reason investors are looking for an exit.

Who Will "Take Over" Leica Camera?

Potential suitors reportedly include private equity firms like HSG and Altor Equity, Asian optical groups, and even German rival Zeiss. However, many eyes are on Xiaomi, whose partnership with Leica has been a resounding success. Leica helped Xiaomi transition from a hardware-focused brand to one recognized for its photographic style, while Xiaomi brought Leica immense brand exposure and record-breaking revenue. But an acquisition is far from a simple decision. The camera market, despite a slight recovery, is minuscule compared to the smartphone market (7.41 million units vs. 1.2 billion units in 2024). For Xiaomi, acquiring Leica would mean a heavy investment in a shrinking sector. Furthermore, Xiaomi's previous attempt at a camera with the Yi Camera failed, indicating a lack of deep commitment to the industry.

The current collaboration is a lightweight, asset-light partnership. An acquisition would be a heavy asset play, contrary to Xiaomi's cautious investment strategy. With the Xiaomi 17 Ultra already securing the top-tier Leica co-branding with the coveted "red dot" logo, there's little incentive to buy the whole company for more brand validation. For Xiaomi, Leica is the icing on the cake; the core ingredients—algorithms, ISP performance, sensors—are handled internally. However, a defensive acquisition isn't out of the question. A new owner could change the terms of the partnership or be a competitor, making it a strategic necessity for Xiaomi to maintain its imaging edge.

Brand Image Diluted, the Leica Logo is Losing Its Luster

Over the past decade, Leica has aggressively tried to find new growth avenues, but these efforts have arguably done more harm than good by diluting its premium image. Beyond its successful mobile partnerships with Huawei and Xiaomi, Leica launched its own Leitz Phone with Sharp. Curiously, it licensed its prestigious "red dot" logo to Sharp while licensing the "Leica" name to Xiaomi, a move that suggests profit was prioritized over brand integrity. The brand also ventured into home projectors, both with its own Home Cinema line and collaborations with brands like JMGO, essentially reselling its imaging prestige in a new category.

Most incongruously, Leica launched high-end mechanical watches, the L1 and L2, attempting to enter the completely unrelated luxury timepiece market, an endeavor that failed to gain traction. This constant brand licensing and cross-category expansion have made the Leica name commonplace. What was once a symbol of exclusive, high-end photography is now seen on a wide array of products, diminishing the very prestige that made it valuable. For a brand whose cameras average over ten thousand dollars, this ubiquity is slowly eroding its high-end appeal. For Leica, the core dilemma is that its most valuable asset, the "Leica" trademark, is also its most over-exploited one. A sale could be a chance for a reset if the new owner invests in rebuilding its core identity. Otherwise, it risks being a brand that is slowly milked of its value until it fades from relevance.